Key Takeaways

|

For decades, the Bloomberg Terminal has been the top choice for professional market data and communication. If you visit a big bank or a hedge fund, you will see traders using these famous black screens.

In 2026, people are asking a new question. It is no longer about what the tool can do, but whether it is still worth the high price tag. With costs reaching $32,000 per user per year and many cheaper competitors available, you need to be sure the benefits justify the expense.

What the Bloomberg Terminal Actually Does

The Bloomberg Terminal is a software platform that acts like a complete operating system for finance. It provides:

- Live prices for stocks, bonds, currencies, and oil.

- Tools to calculate the value of investments and manage risk.

- Instant access to news, company reports, and economic statistics.

- The ability to send buy and sell orders directly to markets.

- A secure chat system used by professionals worldwide.

Everything is in one place to help users work faster. You can use it on a standard computer or through the cloud on other devices. While Bloomberg still offers a special keyboard and a fingerprint scanner to log in, the software is what really matters.

Bloomberg Terminal Cost in 2026

The price of a Bloomberg Terminal has stayed quite high in 2026:

- One license costs about $32,000 per year.

- Companies might get a small discount if they buy many licenses.

- You usually have to sign a contract for two years.

This high price covers more than just data. You are paying for a reliable system that rarely crashes, specialized information you cannot find elsewhere, and access to a massive network of other professionals. For big banks, this is just a necessary cost of doing business. For a single person or a small firm, it is a massive expense.

Where Bloomberg Still Dominates

Even with new competition, Bloomberg is still the leader in specific areas:

- Bonds and Fixed Income: It provides the best data for interest rates and debt markets.

- Global Economics: It easily connects data from different countries, such as currency rates and government debt.

- The Chat Room: The messaging system is the industry standard. If you want to talk to the biggest players in the market, you often need to be on Bloomberg.

- Reliability: When markets are panicking, Bloomberg stays running.

For people who trade bonds or manage massive funds across different countries, these features are hard to replace.

Where Bloomberg Is Overkill

By 2026, many people realize they only use a small part of what Bloomberg offers. You might be paying too much if your work mostly involves:

- Researching and valuing stocks.

- Checking on your portfolio once in a while.

- Investing for the long term instead of trading every hour.

- Reading news and company earnings reports.

In these cases, Bloomberg provides much more power than you actually use. Paying $32,000 for these tasks is becoming harder to justify.

Professional Alternatives to Bloomberg

Several other platforms now offer high-quality tools for a lower price.

LSEG (formerly Refinitiv)

This is a strong rival for currency and bond data. It costs around $22,000 per year and is widely used by large institutions.

FactSet

This tool is a favorite for people who research companies and manage investment portfolios. It is very flexible and usually costs between $4,000 and $12,000 depending on what features you add.

S&P Capital IQ

This platform is excellent for deep research into company finances and specific industries. It can be expensive for teams, but it is very focused on research.

AlphaSense

This tool uses artificial intelligence to search through thousands of documents and transcripts. It is better for finding information buried in text than for active trading.

Affordable Tools for Individual Investors

If you are an individual investor, you can get most of what you need for very little money:

- Yahoo Finance: Good for basic prices and tracking your own stocks.

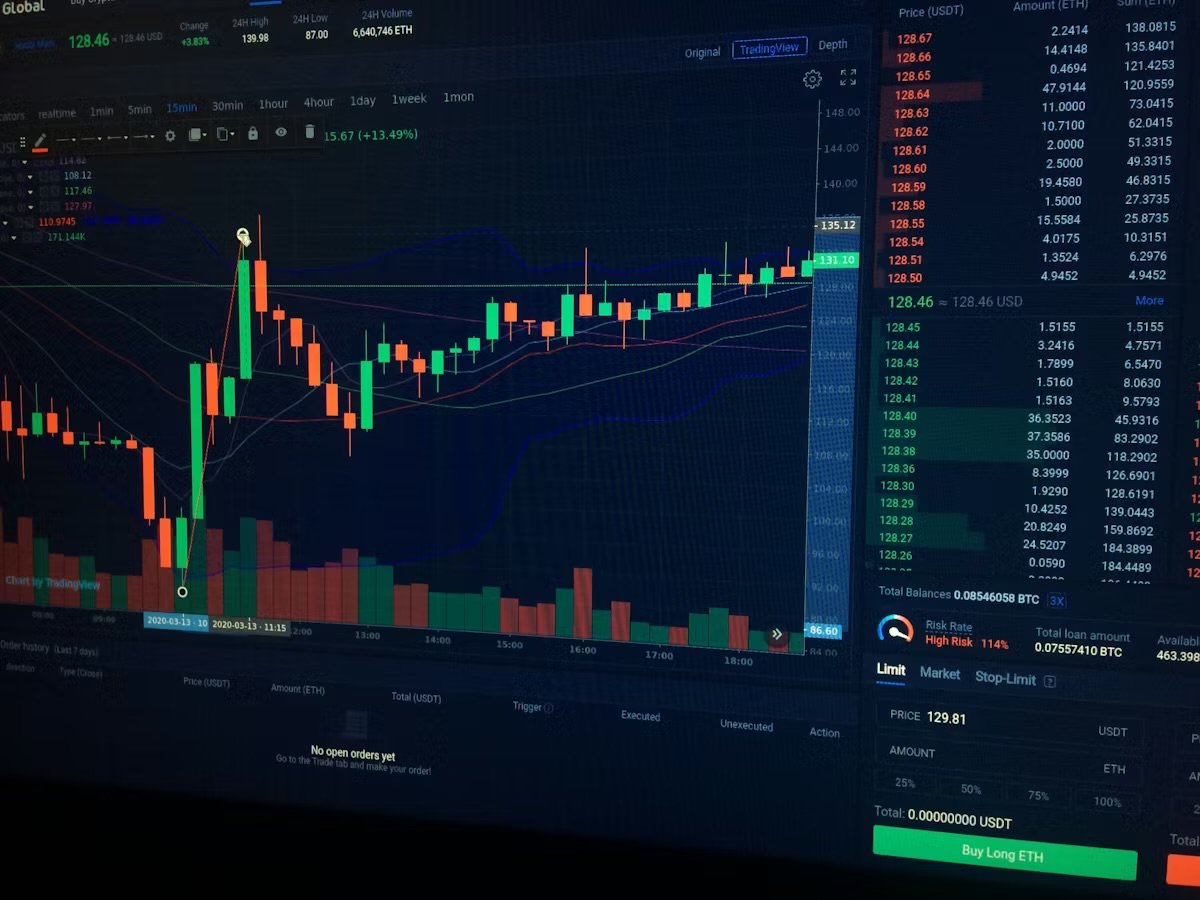

- TradingView: Excellent for looking at charts and technical patterns.

- SEC EDGAR: A free government website where you can read official company filings.

- FRED: A free source for economic data like inflation and employment rates.

- Excel or Google Sheets: Useful for building your own financial models.

By using a few of these tools together, you can get most of the value of a Bloomberg Terminal for almost no cost.

Should You Pay for Bloomberg in 2026?

The right choice depends on your specific job. A Bloomberg Terminal is worth the money if you:

- Trade in the bond or currency markets.

- Need to message other big institutional traders.

- Trade very large amounts of money very quickly.

- Work at a firm where having the best tool is more important than the cost.

It is likely not worth the money if you:

- Are an independent investor or a solo analyst.

- Focus mostly on stocks or long-term goals.

- Do not mind if your data is a few seconds behind.

- Are happy to use a mix of different websites and apps.

Bottom Line

Bloomberg is still the most powerful platform in the world. However, in 2026, being the most powerful is not always enough to justify the price. For big institutions, it is a tool they cannot live without. For individuals, it is often more than they need. The best move is to decide if the extra features are actually worth $32,000 to you. If they aren’t, choosing a cheaper option is a smart financial move.